Teollisuuden Voima Oyj’s Interim Report January–September 2018

22.10.2018

Teollisuuden Voima’s (TVO) climate friendly electricity generation at Olkiluoto 1 and Olkiluoto 2 plant units continued safely through the first three quarters of 2018. At Olkiluoto 3 EPR, preparations for fuel loading continued. Posiva commenced full scale tests of final disposal in it's underground demonstration facilities in June.

Operating Environment

In January 2018, the Ministry of Finance requested an opinion on a draft bill aimed at amending

the provision in the legislation on taxation of business income, which limits the right to deduct

interest. TVO has proposed amendments to the draft bill to avoid additional burden to the energy

sector. The bill is to enter into force at the beginning of 2019.

Preparation of the “Clean Energy for all Europeans” package published by the European

Commission in November 2016 continues. In June, agreement was reached on the 32 percent

target for the share of renewable energy sources by 2030. As regards energy efficiency, a 32.5

percent improvement target by 2030 was agreed.

Trilogue negotiations on the electricity market design began in late June. In the negotiations, e.g.

the rules on capacity mechanisms, that have raised different opinions between Council and

Parliament, will be decided. The negotiating parties did not find accommodation on key questions

in the second official round of negotiations in September.

Financial Performance

TVO operates on a cost-price principle (Mankala principle). TVO's goal is not to make profit or

pay dividends. The shareholders are charged incurred costs on the price of electricity and thus in

principle the profit/loss for the period under review is zero, unless specific circumstances dictate

otherwise. The shareholders pay variable costs based on the volumes of energy supplied and

fixed costs in proportion to their ownership, regardless of whether they have made any use of

their share of the output or not. Because of the Company's operating principle, key indicators

based on financial performance will not be presented.

The consolidated turnover for the period under review January 1–September 30, 2018 was EUR

257.8 (January 1–September 30, 2017: EUR 240.3 million). The amount of electricity delivered to

shareholders was 10,781.7 (9,818.4) GWh. The slightly higher delivery volume to shareholders

was due to higher delivery volumes of both the Olkiluoto plant units and the Meri-Pori coal-fired

power plant compared to the previous year.

The consolidated profit/loss was EUR -3.3 (-3.2) million.

Financing and Liquidity

TVO's financial situation has developed as planned.

TVO's liabilities (non-current and current) at the end of the period in review, excluding the loan

from the Finnish State Nuclear Waste Management Fund relent to shareholders, totaled EUR

4,585.6 (December 31, 2017: 4,412.0) million, of which EUR 679,3 (579.3) million were

subordinated shareholder loans. During the period under review, TVO raised a total of EUR 400

(100.0) million in non-current liabilities. Repayments during the period under review amounted to

EUR 688,7 (175.9) million.

In April, TVO issued a EUR 400 million bond. The maturity of the bond is six years and the

coupon 2%. EUR 306.5 million of the proceeds from the bond were used for the partial

repurchase of the EUR 500 million bond maturing in February 2019. In September TVO raised a

total of EUR 100.0 million subordinated shareholder loans.

In February, Japan Credit Rating Agency downgraded TVO’s long term rating from AA- to A+

and assessed the outlook as stable. In October 2017, Standard & Poor’s (S&P) placed TVO’s long

term issuer rating (BB+) on CreditWatch with negative outlook. In March 2018, S&P removed the

rating from CreditWatch Negative and assessed TVO’s outlook as stable. Fitch Ratings affirmed

TVO's long term rating at BBB- and assessed the outlook as stable on September 2018.

The OL3 EPR project's share of financing costs has been capitalized in the balance sheet.

TVO uses its right to borrow funds back from the Finnish State Nuclear Waste Management

Fund within the framework of legal regulations. On June 30, 2018 the amount of the loan was

EUR 666.2 (December 31, 2017: 655.5) million and it has been relent to the Company's A-series

shareholders. On March 31, 2018, the loan from the Finnish State Nuclear Waste Management

Fund was increased by EUR 10.7 (-371.5) million.

Nuclear Power

Olkiluoto 1 and Olkiluoto 2

The electricity production of the Olkiluoto power plant units Olkiluoto 1 (OL1) and Olkiluoto 2

(OL2) during the period under review was 10,210 (9,719) GWh. The total load factor was 88.3

(84.5) %.

The plant units operated safely and reliably during the period under review. OL1’s net production

was 4,825 (5,430) GWh and the load factor 83.9 (94.5) %. OL2’s net production was 5,385

(4,289) GWh and the load factor 92.6 (74.5) %.

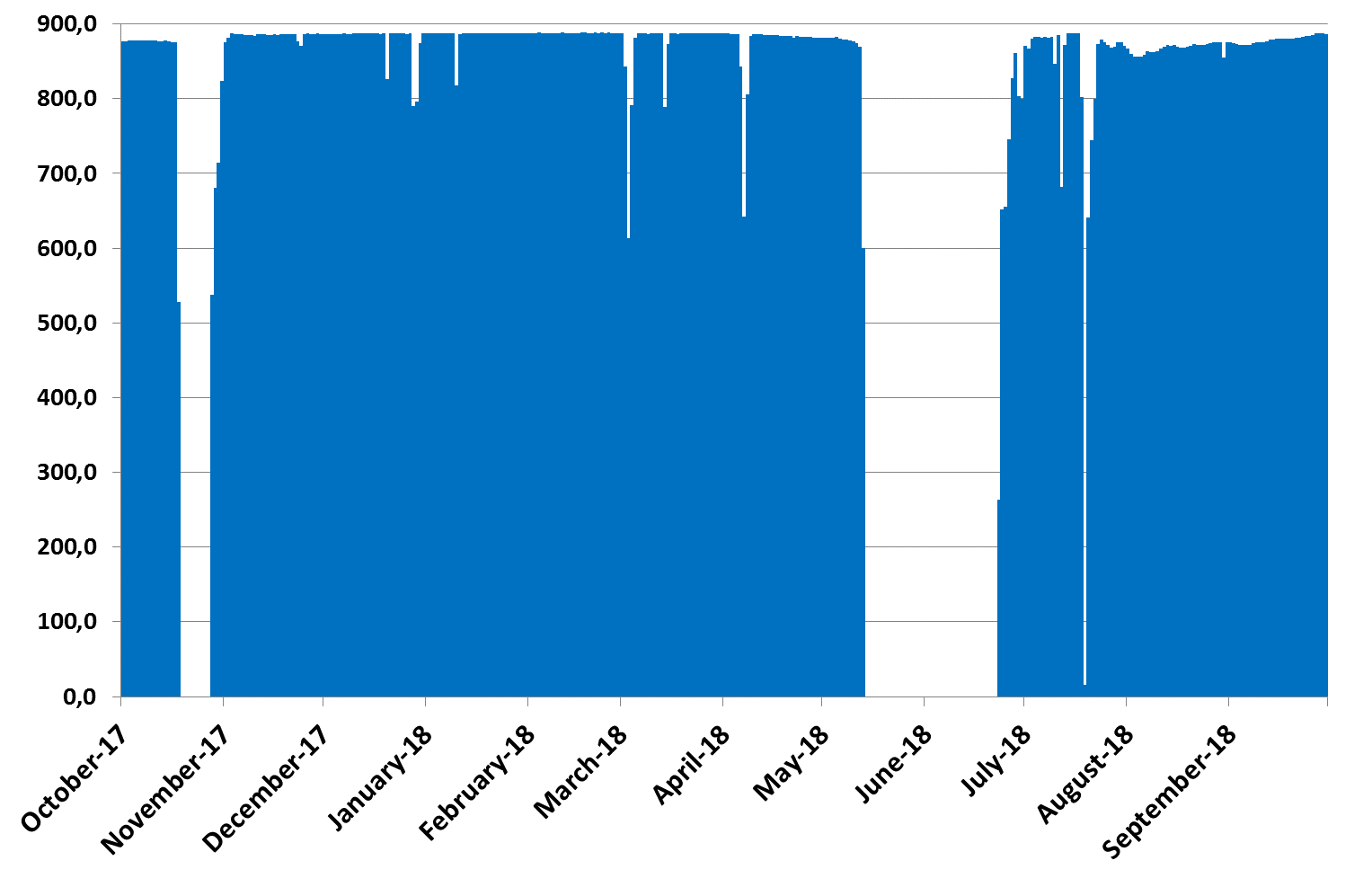

Olkiluoto 1

Average electrical power MW

October 1, 2017–September 30, 2018

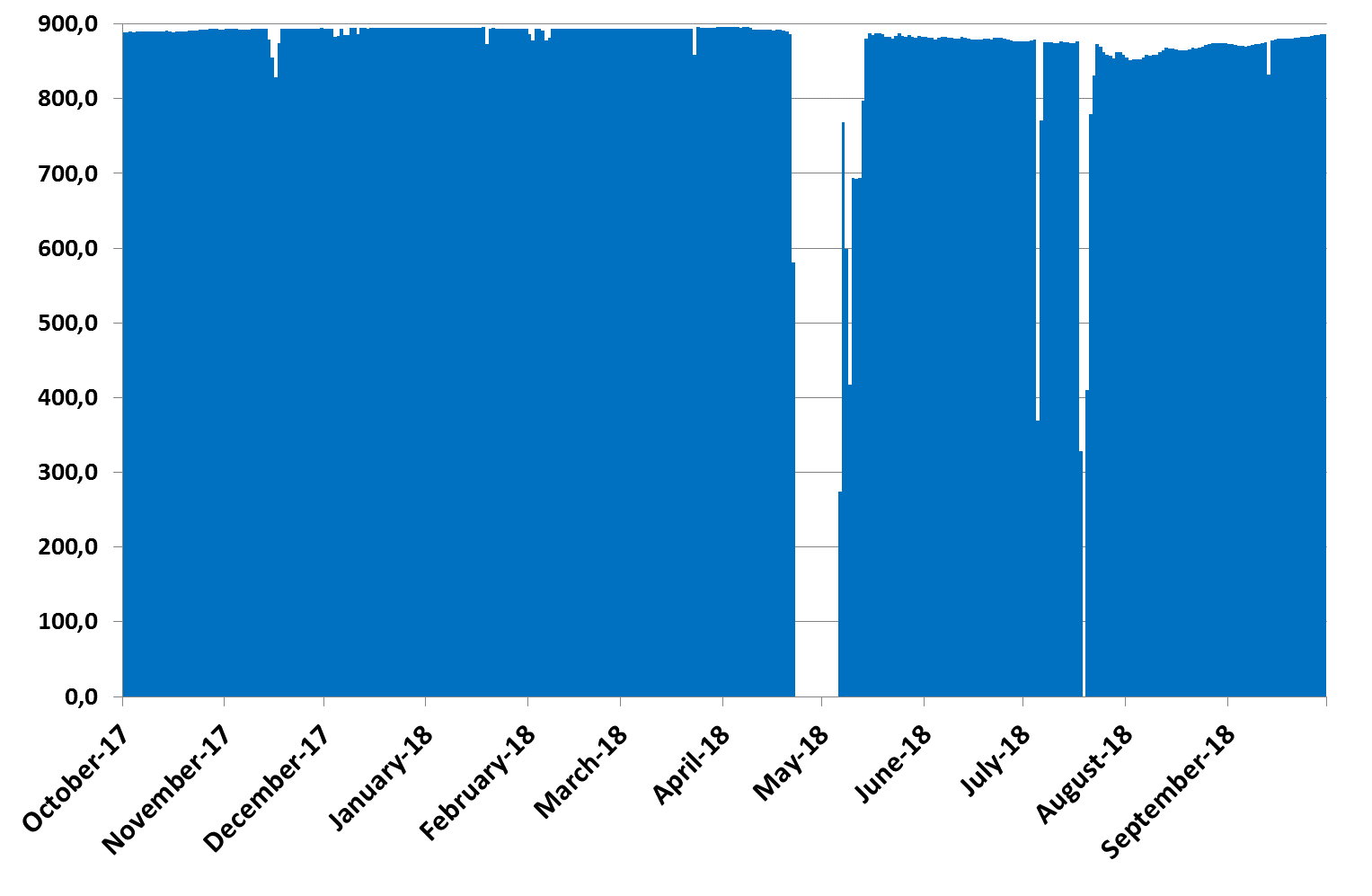

Olkiluoto 2

Average electrical power MW

October 1, 2017–September 30, 2018

The Finnish Government approved on 20 September 2018 the extension of the operating

licences for the Olkiluoto 1 and 2 plant units of Teollisuuden Voima Oyj. The operation of the

plant units can be continued up till the year 2038. TVO submitted application for the extension of

the operating licences to the Ministry of Economic Affairs and Employment in January 2017. The

Government decision was preceded by the positive statement of the Radiation and Nuclear

Safety Authority (STUK) issued in May.

A failure of a 400 kilovolt current transformer at the switchyard operating under the

management of national grid company Fingrid occurred on 18 July 2018. As a result of the event,

the Olkiluoto 2 plant unit (OL2) was automatically disconnected from the electrical system. Later

on the same day the Olkiluoto 1 plant unit (OL1) was disconnected from the national grid due to

a grid disturbance. OL1 was synchronized back to the national grid on 19 July and OL2 on 20

July. The amount of unproduced electricity was approximately 63,920 MWh.

Annual outages

The 2018 annual outages of the Olkiluoto nuclear power plant were started on April 23 with a

refueling outage at OL2. In addition to refueling, the OL2 outage also included annually recurring

maintenance work as well as completion of the installation of a new alternative coolant injection

system. The outage lasted more than 13 days.

At OL1, the annual outage commenced on May 13 and was completed on June 23. The most

important work of the outage at the plant unit included replacement of the main internals pumps

and their frequency converters, renewal of turbine condensers, installation of a new alternative

coolant injection system, high-pressure drain forward pumping, and replacement of the highpressure preheaters and feedwater distributors. A containment leak-tightness test was also

carried out.

In addition to TVO’s own personnel, up to 1,400 contractor employees took part in the 2018

annual outage works.

The refueling and maintenance outages carried out at the plant units on alternating years are

designed to ensure that a good level of operability and production is maintained at the Olkiluoto

nuclear power plant at all times.

Olkiluoto 3 EPR

Olkiluoto 3 EPR (OL3 EPR), a nuclear power plant unit under construction, was procured as a

fixed-price turnkey project from a consortium (Supplier) formed by Areva GmbH, Areva NP SAS

and Siemens AG. As stipulated in the plant contract, the consortium companies have joint and

several liability for the contractual obligations.

In accordance with the Supplier’s schedule updated in June 2018, regular electricity generation at

the plant unit will commence in September 2019. According to the Supplier, fuel will be loaded

into the reactor in January 2019, and the first connection to the grid will take place in May 2019.

According to the Supplier’s plant ramp-up program, the unit will produce 2–4 TWh of electricity,

at varying power levels, during the period of time between the first connection to the grid and

the start of regular electricity production.

The construction work of the plant unit is mainly finished. Electrical, instrumentation and control

(I&C) and mechanical installations are still partly in progress. Simulator training for the operating

personnel commenced in February 2017. The hot functional testing was completed in May 2018.

In the hot functional tests (HFT), the nuclear and turbine island operated for the first time

together as an entity. In HFT it turned out that the pressurizer surge line vibrates. Vibrations will

be corrected by modifying surge line's supporting structures. After approved testing and

disquisition of the solution, TVO will have the prerequisites to receive statement from Radiation

and Nuclear Safety Authority (STUK) on OL3 unit's operating licence, which would allow Finnish

government to give a decision on it. The workforce at the site at the end of the period under

review was about 2,100 persons. Occupational safety at the site remained at a good level.

The business restructuring plan announced by Areva in 2016 was implemented at the beginning

of 2018. The majority of Areva NP’s business was transferred to a company named Framatome,

of which 75.5 percent is owned by Electricité de France (EDF). The OL3 EPR project and the

means required to complete the project, as well as certain other liabilities remained within Areva

NP and Areva GmbH.

A comprehensive settlement agreement between TVO and the OL3 EPR plant supplier

consortium companies was signed and it came into force in March 2018. The settlement

agreement concerns the completion of the OL3 EPR project and related disputes.The agreement

is described in more detail in the paragraph “Pending Court Cases and Disputes”.

All the realized costs of the OL3 EPR project that can be recognized in the cost of the asset have

been entered as property, plant and equipment in the Group balance sheet.

Nuclear Fuel

During the period under review, nuclear fuel purchases amounted to EUR 50.2 (46.4) million and

the amount consumed to EUR 42.7 (38.3) million.

The nuclear fuel and uranium stock carrying value on September 30, 2018 was EUR 249.3

(December 31, 2017: 241.7) million.

Nuclear Waste Management

Under the Finnish Nuclear Energy Act, the Company is responsible for the measures related to

nuclear waste management and the related costs.

The liabilities in the consolidated financial statement show a provision related to nuclear waste

management liability of EUR 974.7 (December 31, 2017: 953.1) million, calculated according to

the international IFRS accounting principles. A corresponding amount, under assets, represents

the Company’s share in the Finnish State Nuclear Waste Management Fund.

In order to cover the costs of nuclear waste management, TVO makes contributions to the

Finnish State Nuclear Waste Management Fund. In December 2017, the Ministry of Economic

Affairs and Employment set TVO's liability for nuclear waste management at EUR 1,481.6

(1,450.1) million to the end of 2017 and the Company's funding target for 2018 at EUR 1,470.8

(1,428.4) million.

In March 2018, the Finnish State Nuclear Management Fund confirmed TVO’s nuclear waste

management fee for 2017 at EUR 33.6 (49.1) million, which was paid into the Fund on March 31,

2018 (March 31, 2017). The nuclear waste management fee for 2018 will be confirmed in March

2019.

Final Disposal of Spent Nuclear Fuel

Posiva Oy is in charge of executing in Olkiluoto the final disposal of the spent nuclear fuel

generated by its owners, TVO at its power plant in Olkiluoto and Fortum at its power plant in

Loviisa.

Suppliers of the main encapsulation building equipment have been selected, and the design

phase of the main equipment has progressed according to plan. In addition, the decision to

construct the encapsulation building is under preparation.

The excavation work of the final disposal facility itself was launched in December 2016.

Excavation of the vehicle access tunnels leading to the final disposal facility and excavation of the

central tunnel for the integrated systems test have been completed. Raise boring of the canister

shaft has been started. The full-scale in-situ system test (FISST) was commenced at the end of

June. The aim of the FISST is to demonstrate that safe final disposal can be implemented as

designed by Posiva. The test is monitored for several years.

At the end of March, Posiva’s owners submitted the Nuclear Waste Management Annual Report

for 2017 to the Ministry of Economic Affairs and Employment (MEAE).

Coal Power

Meri-Pori

The amount of electricity produced by TVO’s share at the Meri-Pori coal-fired power plant on

January 1–September 30, 2018 was 589.2 (122.1) GWh requiring 215.7 (43.6) thousand tons of

coal and 459.5 (107.9) thousand tons of carbon dioxide emission rights.

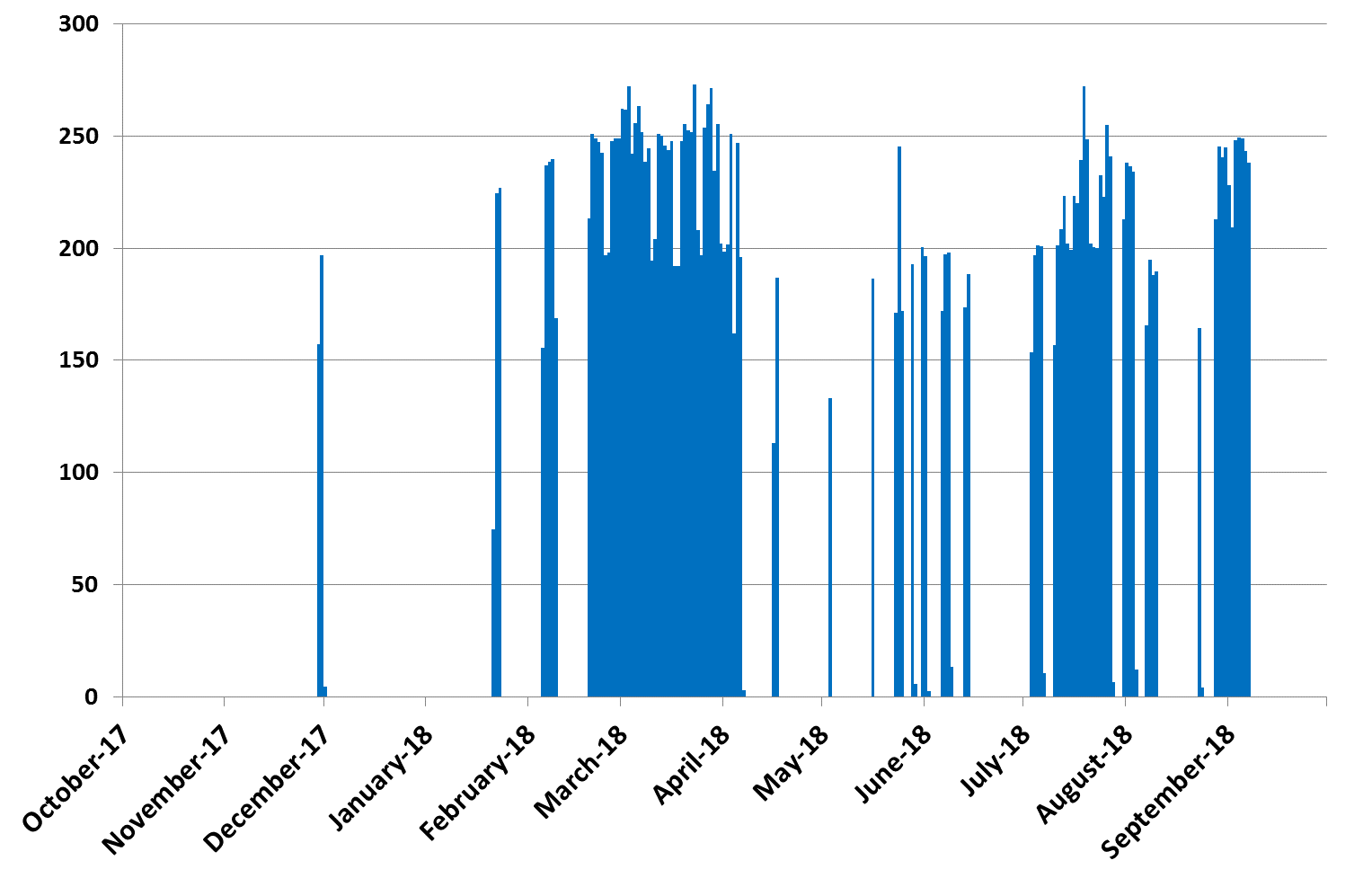

TVO’s share of Meri-Pori’s production

Average electrical power MW

October 1, 2017–September 30, 2018

TVO and its shareholders have agreed on ownership arrangements of shares entitling to a share

of Meri-Pori power plant's production capacity. According to the agreement signed in June,

Fortum will acquire TVO’s shareholders' shares of the production capacity of the Meri-Pori power

plant. Fortum will be entitled to use TVO's share of the Meri-Pori capacity as of the beginning of

2019, and TVO will relinquish its share in Meri-Pori in full in the beginning of July 2020.

Acquisitions of Tangible and Intangible Assets and Shares

Investments during the period under review were EUR 211.2 (225.3) million. Investments of the

parent company were EUR 208.3 (223.0) million, of which EUR 161.7 (160.4) million were

allocated to the OL3 project.

Carbon dioxide emission rights have been relinquished to the Energy Market authority worth

EUR 0.7 (2.7) million. During the period under review, emission rights were acquired worth EUR

7.2 (0.5) million. The Company's need for carbon dioxide emission rights for the period under

review are covered by acquired emission rights.

Pending Court Cases and Disputes

According to the comprehensive settlement agreement signed in March 2018, TVO and the

Supplier jointly withdrew the pending arbitration proceedings under the International Chamber of

Commerce (ICC) rules with respect to costs and losses incurred in relation to delays in the

construction of the OL3 EPR project. In June 2018, the ICC tribunal confirmed the arbitration

settlement by a consent award, and the arbitration proceedings were terminated. The parties

also withdrew the pending appeals in the General Court of the European Union.

The settlement agreement between TVO and the plant supplier consortium companies Areva NP,

Areva GmbH and Siemens AG as well as with Areva Group parent company Areva SA, a

company wholly owned by the French State, concerning the completion of the OL3 EPR project

and related disputes entered into force late March.

The settlement agreement stipulates that:

In order to provide and maintain adequate and competent technical and human resources for the

completion of the OL3 EPR project, Areva will source the necessary additional resources from

Framatome S.A.S., whose majority owner is Electricité de France (EDF).

The supplier consortium companies undertake that the funds dedicated to the completion of the

OL3 EPR project will be adequate and will cover all applicable guarantee periods, including

setting up a trust mechanism funded by Areva companies to secure the financing of the costs of

completion of the OL3 EPR project.

The turnkey principle of the OL3 EPR plant contract and the joint and several liability of the

supplier consortium companies remain in full force.

The agreement also noted the plant supplier’s schedule at the time the agreement was signed,

according to which the regular electricity production in the unit would have commenced in May

2019.

The ICC arbitration concerning the costs and losses caused by the delay of the OL3 EPR project

is settled by financial compensation of EUR 450 million to be paid to TVO in two installments by

the supplier consortium companies.

The parties withdraw all on-going legal actions related to OL3 EPR, including the ICC arbitration

and appeals in the General Court of the European Union.

The supplier consortium companies are entitled to receive an incentive payment, in a maximum

amount of EUR 150 million, upon timely completion of the OL3 EPR project. In the event that the

supplier consortium companies fail to complete the OL3 EPR project by the end of 2019, they

will pay a penalty to TVO for such delay in an amount which will depend on the actual time of

completion of the OL3 EPR project and may not exceed EUR 400 million.

TVO received the first payment of EUR 328 million of the settlement amount in March at the

entry into force of the settlement agreement. The second payment of EUR 122 million is payable

upon completion of the OL3 EPR project or, in any event, on December 31, 2019 at the latest. In

the first quarter of 2018, TVO made a provision of EUR 150 million reflecting the maximum

amount of the incentive payment payable to the supplier consortium companies for timely

completion of the OL3 EPR project as agreed in the settlement agreement. In June 2018, TVO

received from Areva–Siemens Consortium an updated schedule for the commissioning of the

OL3 plant unit. According to the received information, the regular electricity generation at OL3

will start in September 2019, so, in the second quarter of 2018, the provision was withdrawn by

EUR 50 million. These settlement payments to TVO, any incentive payment by TVO and any

penalty payable to TVO due to any additional project delay have all been taken into account in

calculating the final cost of the OL3 EPR project. The amount corresponding to the settlement

amount and the rest part of incentive fee to be paid by TVO have been entered as property, plant

and equipment in the Group balance sheet.

Personnel

The total number of personnel in the Group at the end of the period under review was 874

(December 31, 2017: 807, September 30, 2017: 794). The number of permanent employees in

the Group at the end of the period under review was 855 (December 31, 2017: 784, September

30, 2017: 779).

As the operating phase of OL3 EPR is approaching, the organizations of Electricity Production

and Engineering and Expert Services are being strengthened with several dozens of technical

professionals this year. Recruitments will be continued in 2019.

The Group’s management and operational culture is being developed with the help of the Better

workplace project. The goals of the project include improving efficiency of operations and

securing good preconditions for operations by developing issues related to the work of each

individual, the immediate work community and the entire Group. The progress of the project is

monitored on a regular basis and the project’s effectiveness is measured with e.g. regular

personnel surveys.

Environment

In December 2016, The Regional State Administrative Agency for Southern Finland issued

decisions on the adjustment of the Olkiluoto nuclear power plant’s environmental permit and water permit regulations. Vaasa administrative court gave adjudication on the issue on June 19

and the decisions became final in July.

Annual General Meeting and Changes in Composition of Board of Directors

TVO's Annual General Meeting on March 23, 2018 approved the financial statements for 2017,

confirmed the consolidated income statement and balance sheet, and discharged the members

of the Board of Directors and the President and CEO from liability.

All Board members were re-elected. At its organization meeting, the Board elected Matti

Ruotsala as Chairman and Lauri Virkkunen as Deputy Chairman. The Board also chose from

among its members the members and chairmen of the Board Committees.

TVO's Annual General Meeting had re-elected Lauri Virkkunen as a member of the Board until

July 31, 2018 and elected Ilkka Tykkyläinen as a member of the Board since August 1, 2018. In

August the Board elected Ilkka Tykkyläinen as Deputy Chairman.

Extraordinary General Meeting

At TVO's Extraordinary General Meeting held in June 2018, TVO and its shareholders agreed on

ownership arrangements of shares entitling to a share of Meri-Pori power plant's production

capacity. TVO will relinquish its share in Meri-Pori in full in the beginning of July 2020. Because

of the arrangements the EGM decided to amend the Articles of Association by removing all

provisions pertaining Meri-Pori shares and to reduce the share capital by the proportionate

amount of share capital allocated to these shares (class C shares.) The amendments of the

Articles of Association will be registered at the same time as the decrease in the share capital is

registered. The other amendments to the Articles of Association will be registered when the

cancellation of class C shares is registered.

Auditing

The Interim Report is unaudited.

Risks and Uncertainty Factors in the Near Future

The major risks and uncertainty factors in TVO’s operations have been presented in the 2017

Report of the Board of Directors.

If the draft tax law amendment, which would limit the right to deduct interest, would come into

force and the level of interest would rise, that would mean a considerable risk of additional costs

for TVO.

Assessment of Year-End Developments

Electricity production is expected to continue as in previous years. The prerequisites for nuclear

power production at Olkiluoto are good. Nuclear fuel availability is guaranteed by long-term

agreements.

Preparing the OL3 EPR plant unit for production use will continue with TVO supporting the

Supplier to complete the project. After the hot functional tests, preparation for the fuel loading

which will take several months was launched at OL3 EPR. TVO will submit to the authorities a

number of supplementary documents relating mainly to the findings of the heat functional

testing. After this TVO has the prerequisites to obtain STUK's opinion and safety assessment as well as the Government's decision on the license.

The Meri-Pori coal-fired power plant capacity will be used in 2018 in accordance with the former principles. Fortum’s share of the Meri-Pori power plant has been accepted into the reserve capacity.

The concept and cost optimization phase of Posiva’s final disposal project will continue until the end of 2018.

Events after the Period under Review

TVO published a stock exchange release announcing, that the plant supplier Areva-Siemens

Consortium will perform a schedule review on OL3 project and provide TVO an overall rebaseline schedule for the final phases of the project in December, after the end of the interim report period. TVO cannot estimate whether or not the schedule will influence the start of the regular electricity production.

The Olkiluoto wind power plant was dismantled after it had reached the end of it's lifecycle. The power plant started commercial use in 2005. The dismantle work was completed on 4 October.

OL1 unit was disconnected from national electricity grid on 1 October due to a failure on turbine side. The unit was reconnected to the grid on 2 October.

TVO agreed to transfer it's finance and human resources services to Administer Oy on 15

October. The transfer of business will take place on 1 November 2018 and concerns 14

employees, 12 of whom will be transferred to the new operator.

October 19, 2018

Teollisuuden Voima Oyj

Board of Directors

Share