Debt structure and liquidity

Debt Structure on 30 September 2025

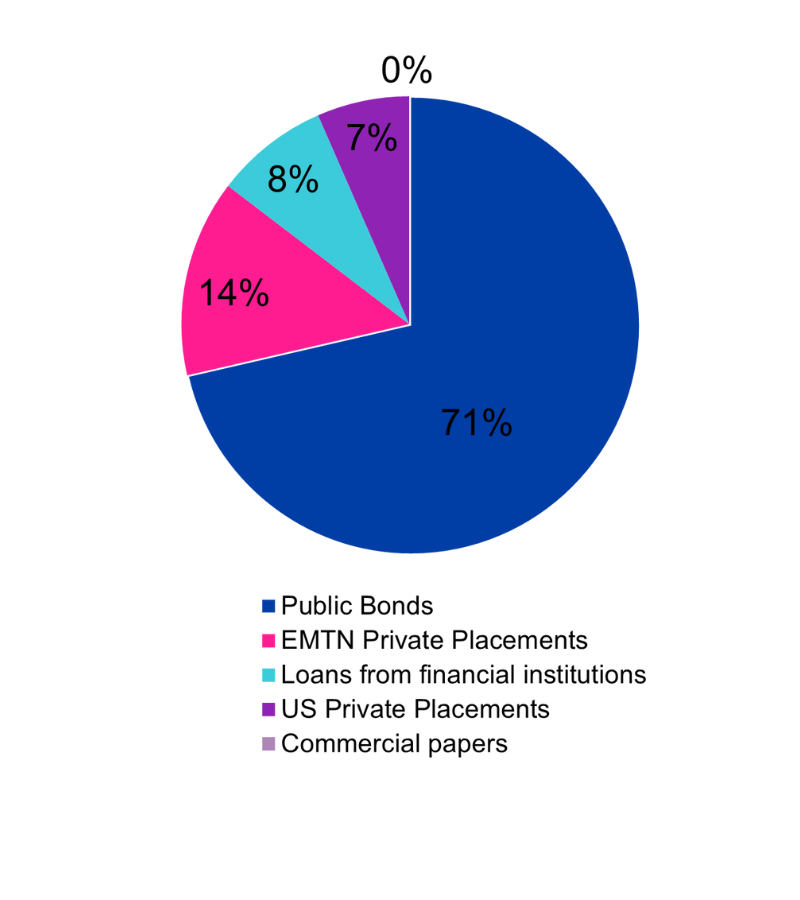

TVO Group Debt Structure

(Loan from the Finnish State Nuclear Waste Management Fund not included)

| MEUR | |

|---|---|

| Public bonds | 3,004 |

| EMTN Private Placements | 597 |

| Loans from financial institutions | 347 |

| US Private Placements | 280 |

| Commercial papers | 0 |

| Total | 4,227 |

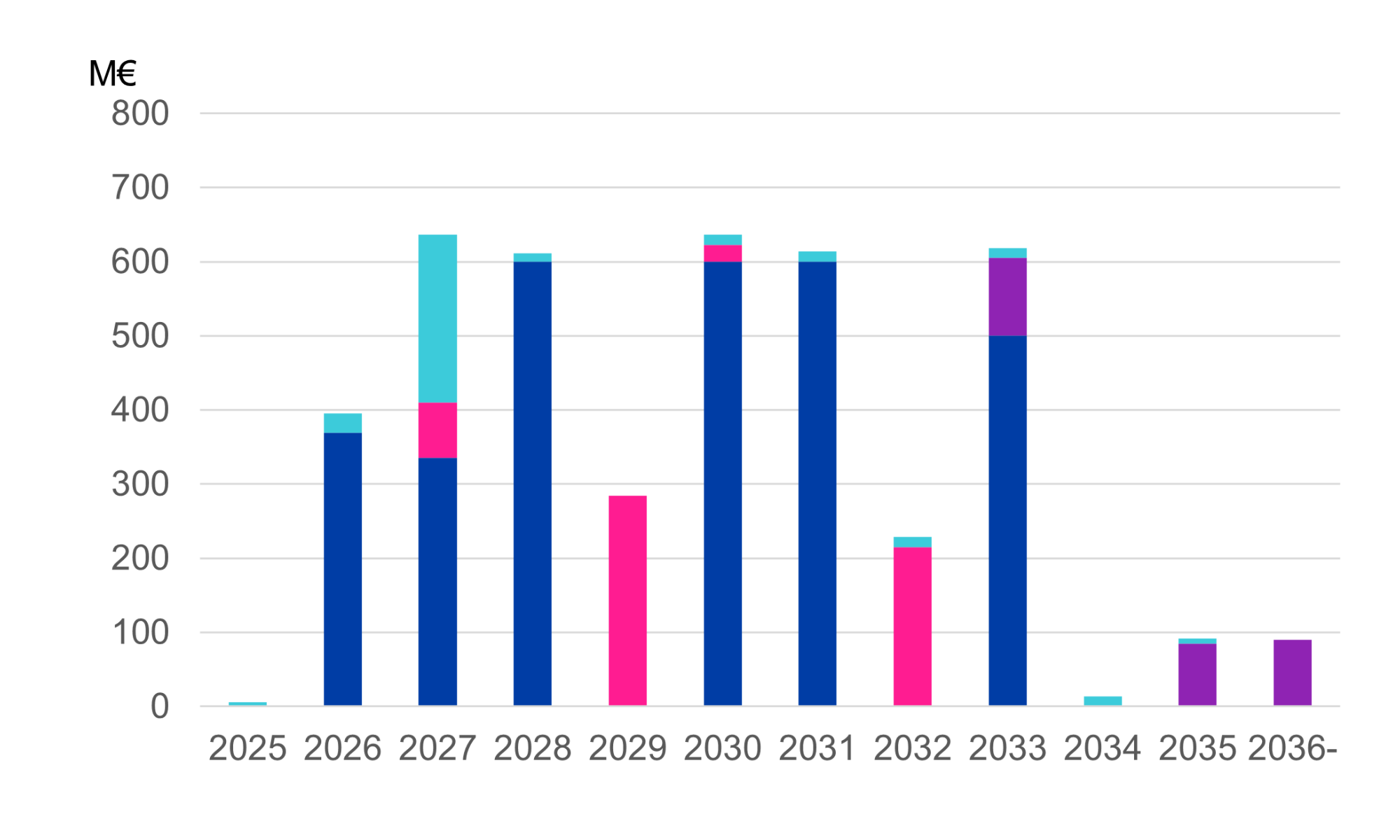

Debt Maturity Profile

| Year | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | 2036- | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MEUR | 6 | 395 | 636 | 612 | 284 | 637 | 614 | 229 | 619 | 14 | 92 | 90 | 4,227 |

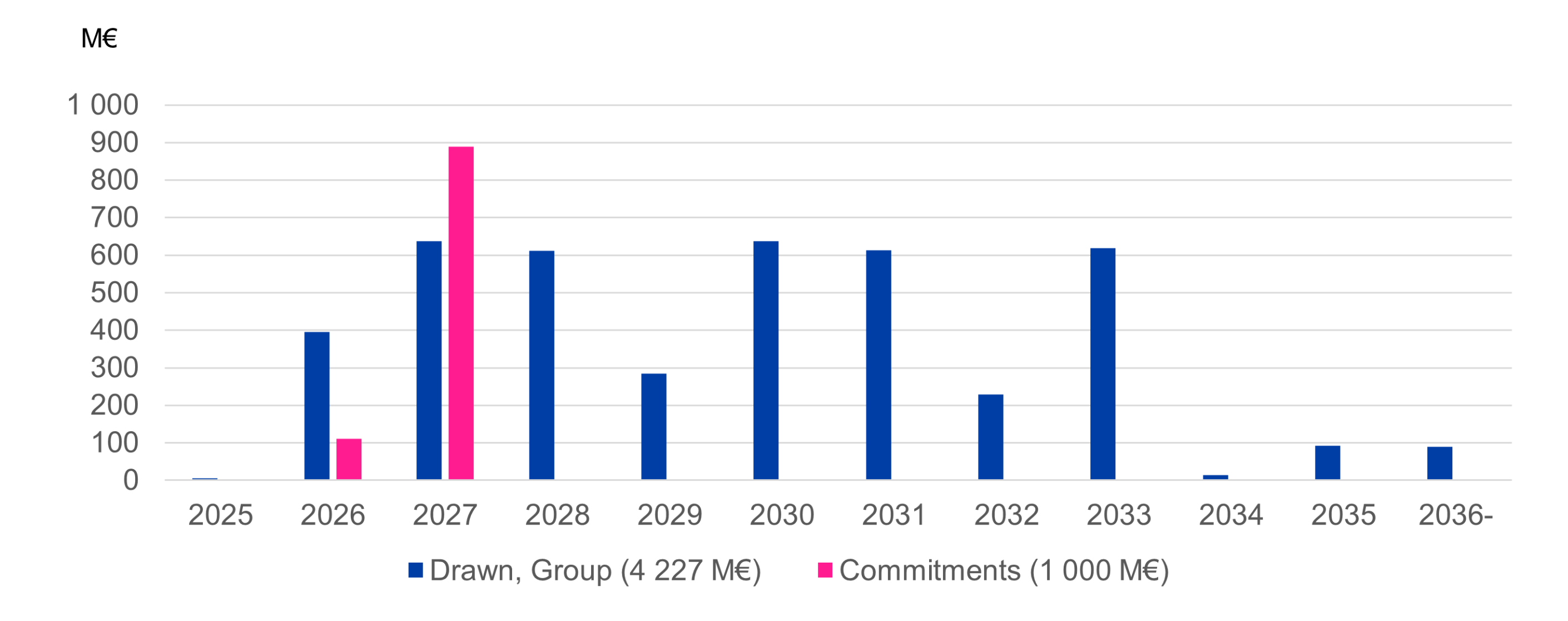

Maturity of Credit Commitments

Liquidity on 30 September 2025

Liquid funds

Cash and cash equivalents EUR 210 million.

Fund investments EUR 100 million.

Short term financing

Finnish Commercial Paper Programme EUR 1,000 million. Emitted amount EUR 0 million.

Committed credit facilities

On 30 September 2025, TVO had undrawn credit facilities amounting to EUR 1,000 million.